Introduction

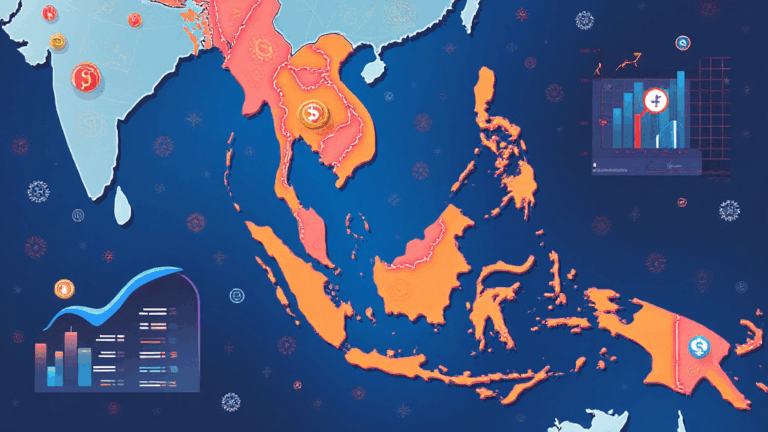

As the crypto landscape continues to evolve, Southeast Asia is emerging as a hotspot for crypto venture capital. With an astonishing $4.1 billion lost to DeFi hacks in 2024, the need for robust investment strategies has never been more critical. In Southeast Asia, the surge of interest in cryptocurrencies is evidenced by substantial user growth rates; for example, in Vietnam alone, the number of active cryptocurrency users has grown by over 150% year-on-year. This article aims to shed light on the current trends, challenges, and opportunities within the realm of crypto venture capital in Southeast Asia.

Understanding Crypto Venture Capital in Southeast Asia

Crypto venture capital refers to investment funds that focus on companies and projects within the cryptocurrency and blockchain space. Southeast Asia has become particularly attractive to crypto venture capitalists due to the region’s favorable regulatory environment, expanding digital infrastructure, and a youthful population eager to adopt new technologies.

As of 2025, approximately 60% of the population in Southeast Asia is expected to be under 35 years old, creating a fertile ground for innovative financial technologies, including cryptocurrencies. Investors in the region recognize that this demographic is not only tech-savvy but also highly adaptable, making them prime candidates for cryptocurrency adoption.

Why Southeast Asia?

1. **Regulatory Advancements**: Countries like Singapore and Vietnam are actively developing frameworks that support cryptocurrency innovation, leading to greater transparency and legitimacy.

2. **Growing User Base**: Various reports indicate that Southeast Asia is home to over 200 million cryptocurrency users, making up a significant portion of the global crypto community.

3. **Investment Opportunities**: The region has seen substantial investments in blockchain startups, driven by both local and international venture capitalists.

The Role of Blockchain Security Standards

The establishment of tiêu chuẩn an ninh blockchain (blockchain security standards) is crucial for enhancing investor confidence. Clear and comprehensive security practices can protect digital assets from hacks. Recent data from Chainalysis indicates that enhanced security protocols can reduce hacking incidents by up to 70%.

Key Challenges Facing Investment in Crypto

While opportunities abound, investors must navigate several challenges:

- **Uncertain Regulations**: Despite improvements, regulatory uncertainty still exists in many Southeast Asian countries.

- **Market Volatility**: The volatile nature of cryptocurrencies poses risks to investor capital.

- **Technology Gaps**: The rapid advancement of technology means that investors need to stay informed and adaptable.

Identifying Promising Investments

Identifying the right investment opportunities in the crypto space requires a strategic approach. As of 2025, research indicates that the most promising investments may include:

- **Decentralized Finance (DeFi) Startups**: With innovative solutions to traditional banking, DeFi remains a hotbed for venture capital investment.

- **NFT Platforms**: The rise of non-fungible tokens has attracted significant interest, particularly in sectors like art and gaming.

- **Layer 2 Solutions**: As scalability becomes more important, investing in projects that enhance blockchain efficiency may provide substantial returns.

Conclusion

In conclusion, the landscape of crypto venture capital in Southeast Asia is ripe with opportunity, fueled by a young population, favorable regulations, and advancing technology. However, investors must remain vigilant, considering both the potential rewards and inherent risks in this volatile market. By leveraging insights into blockchain security standards and market trends, investors can make informed decisions that contribute to the growth of the cryptocurrency ecosystem in the region. For those looking to navigate the complexities of this market effectively, platforms like coinca111 provide essential resources and guidance, empowering users to explore the innovative world of cryptocurrency investments.