Arbitrum vs Optimism vs Base: A Comparative Analysis of Layer 2 Solutions

In the rapidly evolving world of cryptocurrencies, securing a robust infrastructure has become more critical than ever. With billions lost to security vulnerabilities and hacks, understanding how different Layer 2 solutions operate is essential for developers and users alike. Presently, three major contenders are leading the landscape: Arbitrum, Optimism, and Base. By the end of this article, you will have a comprehensive understanding of these platforms and will be equipped to make informed decisions about which to utilize in your projects.

Understanding Layer 2 Solutions

To appreciate the significance of Arbitrum, Optimism, and Base, it’s crucial to grasp the concept of Layer 2 solutions. These platforms augment the Ethereum blockchain’s capabilities by improving scalability and reducing transaction costs. Think of Layer 2 like optimizing a busy highway — it keeps the traffic flowing smoothly while alleviating congestion.

What Are Arbitrum, Optimism, and Base?

- Arbitrum: Introduced by Offchain Labs, Arbitrum leverages optimistic rollups to enhance Ethereum’s scalability. It allows smart contracts to execute off-chain, reducing congestion and fees on the main Ethereum network.

- Optimism: This protocol, developed by Optimism PBC, also employs optimistic rollups to improve transaction speeds and lower costs. It focuses on simple user experiences and interoperability with existing Ethereum tools.

- Base: A newer addition developed by Coinbase, Base aims to provide a secure environment for decentralized applications by utilizing a combination of scalability solutions, including optimistic rollups.

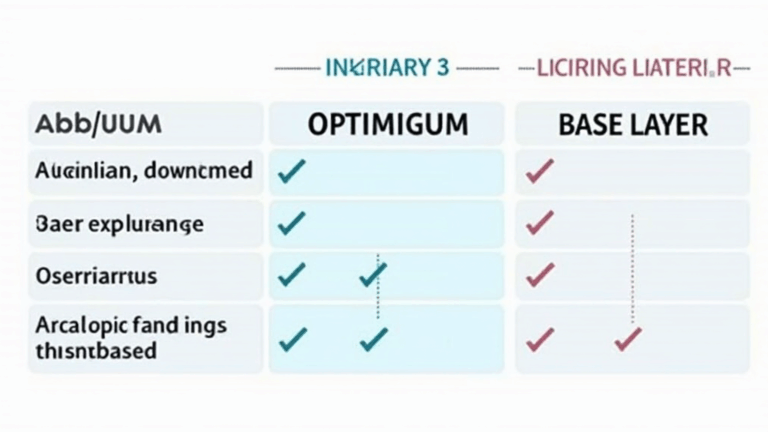

Comparative Analysis

Now, let’s dive deeper into the strengths and weaknesses of each platform, and ultimately determine which might suit your needs better.

1. Scalability and Performance

When it comes to scalability, the ability to handle a large number of transactions efficiently is paramount. Both Arbitrum and Optimism utilize optimistic rollups, which enable higher throughput by processing transactions off-chain, subsequently submitting them on-chain.

- Arbitrum: Offers significant scalability, processing up to 40,000 transactions per second. This reduces congestion on the Ethereum mainnet, paving the way for smoother transactions.

- Optimism: Similar to Arbitrum, but generally handles a slightly lower transaction volume than Arbitrum, estimated at around 30,000 transactions per second.

- Base: Currently in the experimental phase, Base showcases promising scalability, but its upper limits are yet to be firmly established. The ongoing development aims to achieve comparable scalability with a focus on security and ease of use.

2. Security Features and Vulnerabilities

Security is a primary concern for any blockchain application. Vulnerabilities can lead to devastating losses, as shown by past incidents where over $4.1B was lost to DeFi hacks in 2024 alone. Each of these platforms has unique approaches to address security:

- Arbitrum: Implements a decentralized fraud-proof mechanism that ensures transactions are validated. This means that even if malicious actors attempt to submit false transactions, they can be challenged, ensuring high security.

- Optimism: Similarly reliant on its fraud-proof system, Optimism optimizes its smart contract security with simplified user interfaces that make participation less daunting for newcomers, while still adhering to strict security standards.

- Base: Employing multi-layer security protocols, Base has a rigorous verification process for any submitted transactions. However, being a new player, it is yet to face real-world stress tests.

3. User Experience and Developer Support

For a platform to thrive, user experience and comprehensive developer resources are vital. Let’s see how they fare:

- Arbitrum: Known for a strong community and comprehensive developer documentation, Arbitrum provides ample support for those looking to develop dApps on its network.

- Optimism: Optimism emphasizes creating a friendly entry point for developers and users alike, featuring extensive tutorials and guides on utilizing their network without extensive blockchain knowledge.

- Base: Being backed by Coinbase, Base is geared towards mass adoption and ease of use. The user interface is designed with novices in mind, and there’s a wealth of resources available, thanks to its connection with the Coinbase ecosystem.

The Vietnam Market Opportunity

As we contemplate the future of these Layer 2 solutions, it’s essential to consider their global impact, particularly in emerging markets like Vietnam. According to a recent report, Vietnam boasts a remarkable 30% growth rate in cryptocurrency adoption, making it one of the fastest-growing regions for digital assets.

With a growing interest in decentralized finance and NFTs, platforms like Arbitrum, Optimism, and Base must tailor their solutions to attract and engage Vietnamese users effectively. For instance, integrating localized payment solutions or ensuring compliance with local regulations would significantly bolster user trust and enhance platform adoption.

Conclusion

In conclusion, choosing between Arbitrum, Optimism, and Base ultimately depends on your specific needs as a developer or user. If scalability is your utmost priority, Arbitrum may have the edge with its proven track record. Conversely, if user-friendliness and community support are what you seek, then Optimism could be the right fit. Lastly, Base presents an exciting opportunity for newcomers to the cryptocurrency space, offering a unique blend of security and ease of access.

As we venture into the future of decentralized technologies, staying informed about emerging platforms and their capabilities is essential for success in the ever-evolving cryptocurrency landscape. So, whether you’re a developer, user, or investor, keeping an eye on these Layer 2 solutions is vital for navigating the bustling world of digital assets.

In summary, as we gauged the features and advantages of Arbitrum, Optimism, and Base, we see distinct pathways towards enhancing blockchain scalability and security. As new developments emerge, particularly in vibrant markets like Vietnam, these platforms will undoubtedly shape the contours of deferred transactions in 2025 and beyond.

Disclaimer: This article is not financial advice. Please consult local regulators before making investment decisions. For more insights and trends, visit Coinca111.