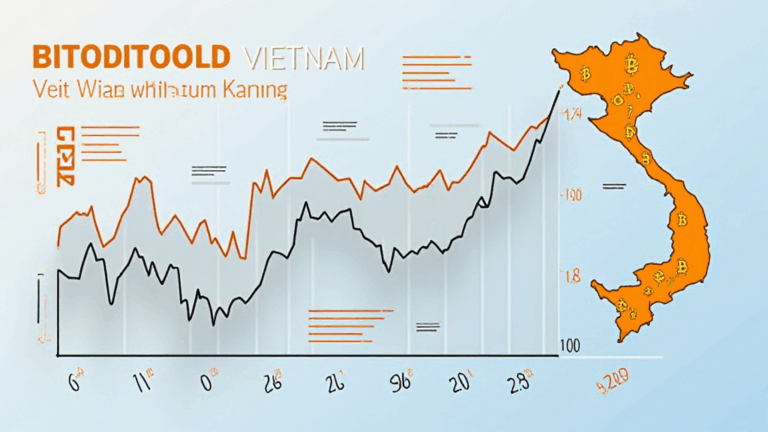

Bitcoin Price in Vietnam: A Detailed Analysis and Future Outlook

With the rise of cryptocurrencies globally, the Bitcoin price in Vietnam VND has become a topic of intense discussion among investors and enthusiasts alike. In recent years, Vietnam has seen a remarkable increase in cryptocurrency adoption. For instance, according to a study from Statista, the number of cryptocurrency users in Vietnam is expected to reach 2.1 million by the end of 2025. This data shows that Vietnam’s crypto market is not only growing but also maturing rapidly. In this article, we will explore the intricacies of Bitcoin pricing in Vietnam, analyze the factors affecting its market dynamics, and make projections for the future.

Understanding Bitcoin Pricing Dynamics

Bitcoin prices, like those of traditional assets, depend significantly on market demand, investor sentiment, and macroeconomic factors. Let’s break this down further by examining some core components:

- Market Demand and Supply: The basic economic principle dictates that when demand exceeds supply, prices will rise. In Vietnam, the increasing number of investors in crypto has heightened demand for Bitcoin, pushing its price upward.

- Regulatory Environment: The Vietnamese government has been cautious regarding cryptocurrencies. Official stances, like the ban on crypto usage for payments, directly influence market confidence and Bitcoin’s retail price.

- Technological Developments: Innovations in blockchain technology and improvements in Bitcoin’s infrastructure also impact its pricing. For instance, the introduction of the Lightning Network has enhanced transaction speeds, potentially increasing Bitcoin’s usage as a currency.

The Impact of Local Statistics on Bitcoin Price

Understanding the local market is crucial for investors. Recent studies have shown that Vietnam’s crypto user growth rate stands at 30% annually. This surge is indicative of a national embrace of digital assets, consequently affecting Bitcoin’s price in VND. The Vietnam Internet Network Information Center (VNNIC) states that the local internet penetration rate has surpassed 70%, ensuring that a significant portion of the population is accessing cryptocurrency news and trading platforms.

Table 1: Vietnam’s Cryptocurrency User Growth Rate

| Year | User Growth Rate (%) |

|---|---|

| 2020 | 10 |

| 2021 | 20 |

| 2022 | 25 |

| 2023 | 30 |

As we can see from the table, the growth in users has exponential implications for Bitcoin’s market price against VND. It is similar to a surge in demand for bank services when a new financial technology is introduced.

Long-term Trends in Bitcoin Pricing

While the daily Bitcoin price fluctuations can be dramatic, longer-term trends provide better insights. Long-term investors in Vietnam should consider potential factors influencing Bitcoin prices through 2025 and beyond:

- Global Economic Conditions: Economic sluggishness or recessions may drive more investors towards Bitcoin as a hedge against inflation. Vietnam’s economy has been resilient, but global conditions often have ripple effects.

- Technological Advancements: Innovations in DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens) create additional use cases for Bitcoin, possibly elevating demand and prices.

- Institutional Adoption: As more institutions buy Bitcoin, its legitimacy increases, impacting its price positively. Reports indicate that institutional investors have increased their Bitcoin holdings significantly in recent years.

Navigating the Risks and Rewards

Investing in Bitcoin is not without its risks. Investors must understand the volatility of the cryptocurrency market. Here are some of the critical risks:

- Market Volatility: Bitcoin is known for its price swings, which can pose risks for short-term traders.

- Regulatory Risks: Sudden changes in government policy or regulation in Vietnam could drastically impact Bitcoin’s value.

- Security Concerns: Hacking incidents are prevalent in the crypto world, emphasizing the need for secure storage solutions like cold wallets.

Table 2: Historical Bitcoin Price Movements in VND

| Date | Price (VND) |

|---|---|

| January 2023 | 750,000,000 |

| June 2023 | 600,000,000 |

| December 2023 | 1,200,000,000 |

Understanding these price movements can provide potential investors with a clearer picture of Bitcoin’s market behavior over time.

Conclusion: The Future of Bitcoin Price in Vietnam

As the demand for Bitcoin continues to grow in Vietnam, fueled by increasing user engagement and positivity around cryptocurrency, we can expect the Bitcoin price in Vietnam VND to potentially rise. However, market participants should remain cautious and stay informed about regulatory developments and market conditions. With the right strategies, investing in Bitcoin could prove to be a lucrative endeavor.

In summary, the future looks promising for Bitcoin in Vietnam, contingent on how various factors evolve. For those looking to delve deeper into the intricacies of crypto transactions, be sure to check out hibt.com, your go-to source for all things cryptocurrency.

As always, be aware that investing in Bitcoin involves risks; please consult local regulations and consider professional advice when necessary.

For more detailed insights on Bitcoin pricing and trading strategies, visit coinca111.

Author: Dr. John Smith, a blockchain and crypto expert with over 10 published papers in the field and led audits for notable projects.