Introduction

As the world increasingly moves towards digital transactions, Southeast Asia is emerging as a significant battleground for cryptocurrency adoption. In 2024 alone, over $4.1 billion was lost to hacks in decentralized finance (DeFi), highlighted the urgent need for robust crypto payment gateways that ensure security and efficiency. With a rapidly growing user base, especially in countries like Vietnam, the demand for secure and reliable crypto payment options is vital. This article will dive into the current landscape of crypto payment gateways in Southeast Asia, exploring their significance, challenges, and future prospects.

The Rise of Crypto Payment Gateways in Southeast Asia

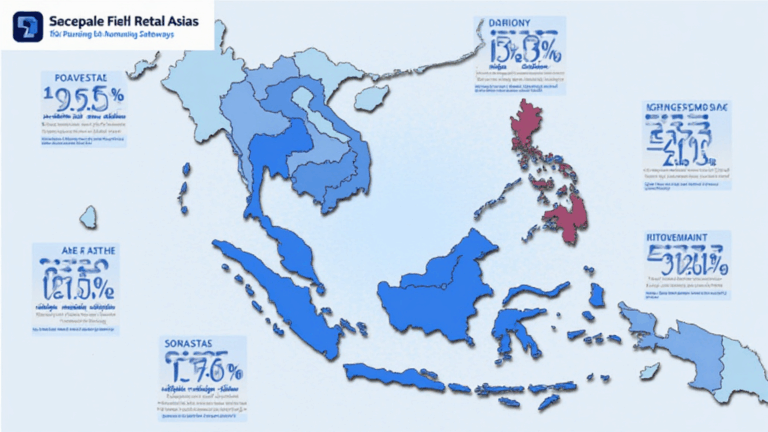

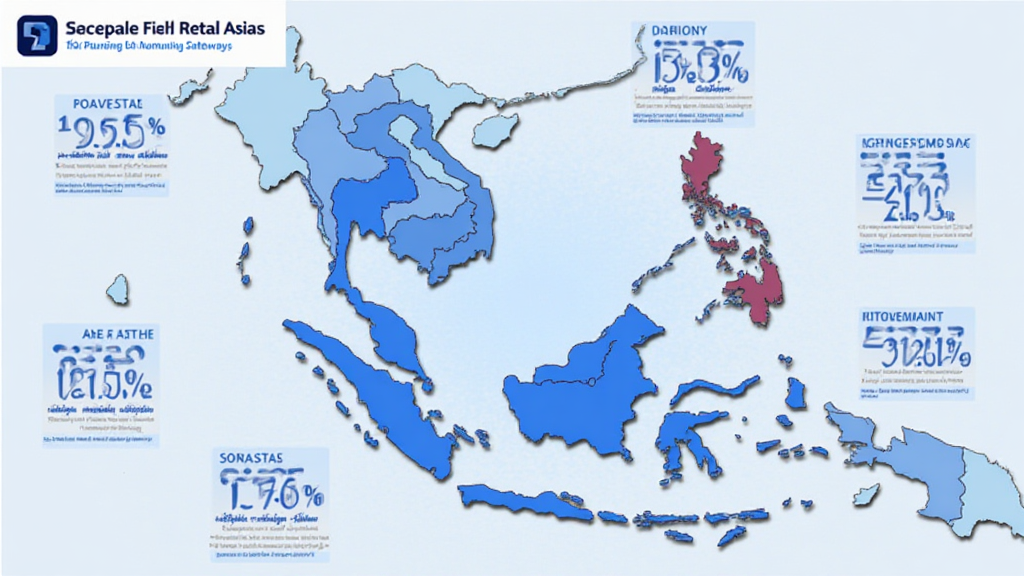

Recent data shows that the cryptocurrency market in Southeast Asia has experienced extraordinary growth, with Vietnam leading the charge. According to a report by Chainalysis 2025, the country boasted a staggering growth rate of 36% in crypto users from 2023 to 2024. The rapid rise can be attributed to the increasing acceptance of blockchain technology, more businesses integrating cryptocurrency into their payment systems, and a more extensive network of online platforms facilitating these transactions. These gateways are crucial infrastructure for facilitating retail and e-commerce transactions in the digital economy.

Understanding Crypto Payment Gateways

A crypto payment gateway acts similarly to a traditional payment processor, allowing businesses to accept cryptocurrencies as payment for their goods and services. Here’s how it typically works:

- The customer selects their desired cryptocurrency at checkout.

- The crypto payment gateway converts the cryptocurrency amount into the local currency in real-time.

- The funds are securely transferred to the merchant’s wallet, completing the transaction.

This system not only improves transaction speed but also expands the customer base for merchants eager to tap into the growing crypto community.

The Advantages of Using Crypto Payment Gateways

The adoption of crypto payment gateways in Southeast Asia offers several advantages:

- Lower Transaction Fees: Compared to credit card processing, which can incur fees above 3%, crypto transactions generally present a lower cost to merchants.

- Increased Transaction Speed: Cryptocurrencies enable faster processing times, meaning merchants can receive payments almost instantly.

- Access to Global Markets: Accepting cryptocurrencies opens up new markets, allowing businesses to reach international customers without currency conversion headaches.

Challenges Faced by Crypto Payment Gateways

While the benefits are numerous, there are also significant challenges that must be addressed:

- Regulatory Compliance: Each country within Southeast Asia has different regulations regarding crypto transactions. Ensuring compliance can be complex and costly.

- Volatility: Cryptocurrency prices can fluctuate wildly, posing a risk for merchants who accept them. Integrating mechanisms to hedge against this risk is essential for stability.

- Security Concerns: With over $4.1 billion lost to hacks in DeFi in 2024, security is paramount. Payment processors must prioritize robust security measures to protect against cyber threats.

Security Standards for Blockchain

In response to the inherent security risks, the tiêu chuẩn an ninh blockchain (blockchain security standards) have emerged as benchmarks for crypto payment gateways. These standards dictate how transactions are processed and stored, ensuring they meet strict security requirements. Companies investing in security enhancements, such as multi-signature wallets and decentralized storage solutions, are more likely to succeed in the long term.

The Future of Crypto Payment Gateways in Southeast Asia

Looking forward, the potential for growth in Southeast Asia’s crypto payment gateways is immense. With the projected increase in crypto users and technological advancements, several trends are expected to shape this landscape:

- Increased Merchant Adoption: As more merchants recognize the benefits of crypto payments, the adoption rate is likely to rise, potentially leading to a more robust economic ecosystem.

- Integration with Traditional Banking: Partnerships between crypto platforms and conventional banks may enhance user experiences and expand access to digital currencies.

- Advancement of Payment Technology: Innovations in blockchain technology could lead to more efficient, user-friendly payment solutions, making crypto transactions even more appealing.

Conclusion

As cryptocurrencies continue to seep into the mainstream, the role of crypto payment gateways Southeast Asia is becoming increasingly important. With a solid foundation built upon security standards, regulatory compliance, and technological advancements, these gateways are set to revolutionize the way businesses transact. Businesses keen on staying ahead should consider investing in these payment solutions to capture the growing wave of crypto users. For further insights on navigating the crypto landscape, explore more at coinca111.